A big chunk of the money 17-year-old Brad Allen made at his summer job is gone, scooped up by a scammer who called him under the guise of CIBC.

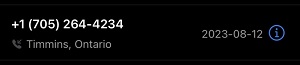

He even verified that the number matched that of his Timmins branch, when he got a call asking him to enter a code to retrieve a message.

There was no message, and the next day he discovered that his account had been compromised.

“I had $114 left in my account,” Allen says. “They tried to steal two-thousand dollars, only got away with a thousand.”

CIBC returned the second thousand dollars, because it hadn’t gone through, but couldn’t get the first thousand.

The bank says it’s at the end of what it can do for Allen.

“I hope not,” he expresses, ”because I hope to get my money back, as I spent my entire summer working to get that money, and just for it to all go down the drain just hurts.”

Here is a written statement from CIBC spokesperson Tom Wallis:

Scammers impersonating trusted organizations is unfortunately on the rise and can affect anyone. One-time verification codes to authorize a password reset or a transaction clearly state that they should not be shared with anyone, and that we will never ask a client for this code. While this is a very unfortunate situation, we were able to prevent further loss to the client. Clients have a role to play in recognizing scams and protecting themselves against them, including keeping personal or banking information safe and secure, and not sharing it with anyone. If you’re suspicious, end the call and contact your bank using the official phone number found on the back of your card or the website.

Additional points:

- Don’t rely on caller ID or the caller’s knowledge of your banking and general personal information.

- We will also never ask that money to be sent to us via cryptocurrencies, gift cards, or electronic money transfers. These scams often involve victims being coached to misinform their bank when asked about the purpose of the transaction, therefore it’s important to always be forthright when speaking with your bank about a withdrawal, payment or transfer, as once you authorize a transaction, it will be processed.

- We actively work to educate our clients on impersonations and other scams (e.g. client emails, statement messaging, ATMs, mobile app spotlights, IVR, etc.)

- To learn how to spot and protect yourself from this and other scams, visit your bank’s website and the CBA website.

The caller ID number checked out to belong to Brad Allen’s CIBC branch. (Photo submitted)